Mastercard priceless benefits

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories

You are currently in Jersey

Our personal cards services are also available in Guernsey, Bermuda and the Cayman Islands

Butterfield’s new credit cards come with a range of handpicked local offers and exclusive freebies, giving you fantastic savings across some of the biggest names in the Channel Islands.

Annual Fee: £0.00

Maximum Credit Limit: £15,000

Representative APR: 21.95%*

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories

Discover Mastercard priceless

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories

Fast Track allows passengers to have preferential access to a dedicated lane straight to the security checkpoint, speeding up the checkpoint process. Simply register with your eligible Mastercard card to get your journey off to a great start.

Global Data Roaming by FlexiRoam gives you access to over 520 network operators in over 120 Countries

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories.

Enjoy exclusive Platinum benefits.

Fast Track allows passengers to have preferential access to a dedicated lane straight to the security checkpoint, speeding up the checkpoint process. Simply register with your eligible Mastercard card to get your journey off to a great start.

Global Data Roaming by FlexiRoam gives you access to over 520 network operators in over 120 Countries

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories.

As a Butterfield cardholder, you are eligible for a complimentary membership of Priority Pass, with 3 free visits per membership year. Once you enrol you will have access to 1,700+ participating airport lounges worldwide.

Mastercard Concierge provides countless advantages of membership, from privileged access and priceless experiences to curated recommendations. To activate the Mastercard Concierge service please call +44 (0) 808 175 6552 (select option 3)

Fast Track allows passengers to have preferential access to a dedicated lane straight to the security checkpoint, speeding up the checkpoint process. Simply register with your eligible Mastercard card to get your journey off to a great start.

Global Data Roaming by FlexiRoam gives you access to over 520 network operators in over 120 Countries

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories.

Our World Elite Black features a specially curated package of benefits.

As a Butterfield cardholder, you are eligible for a complimentary membership of Priority Pass, with 3 free visits per membership year. Once you enrol you will have access to 1,700+ participating airport lounges worldwide.

Mastercard Concierge provides countless advantages of membership, from privileged access and priceless experiences to curated recommendations. To activate the Mastercard Concierge service please call +44 (0) 808 175 6552 (select option 3)

Fast Track allows passengers to have preferential access to a dedicated lane straight to the security checkpoint, speeding up the checkpoint process. Simply register with your eligible Mastercard card to get your journey off to a great start.

Global Data Roaming by FlexiRoam gives you access to over 520 network operators in over 120 Countries

Welcome to priceless, where each experience is crafted to be exceptional. Pursue your passions. Access world-class events. Create lasting memories.

The repayment date is the 18th of each month (or the next working day).

Using Butterfield Online

If you are a Butterfield Online user you can use the pay my credit card option from any of your sterling current accounts.

Online from your bank’s internet banking service

Account number: 99999999

Account name: Butterfield Bank (Channel Islands) Limited

Sort Code: 60‐83‐98

Reference: Quote account number beginning with CA___

*Please note your account number with the CA prefix must be included in the reference. Your account number can be found on your statement.

For payments on direct debit, we will claim the funds from your nominated account on the following dates:

2026

15 January 2026

16 February 2026

16 March 2026

16 April 2026

14 May 2026

16 June 2026

16 July 2026

14 August 2026

16 September 2026

15 October 2026

16 November 2026

16 December 2026

Butterfield Card Services: +44 (0) 808 175 6552

(Lines open 24/7 for fraud or lost/stolen card issues & to activate your Butterfield Cards CI App. For all other queries lines are open 9am - 5pm, Monday to Friday.)

E-mail us: [email protected]

For card complaints: [email protected]

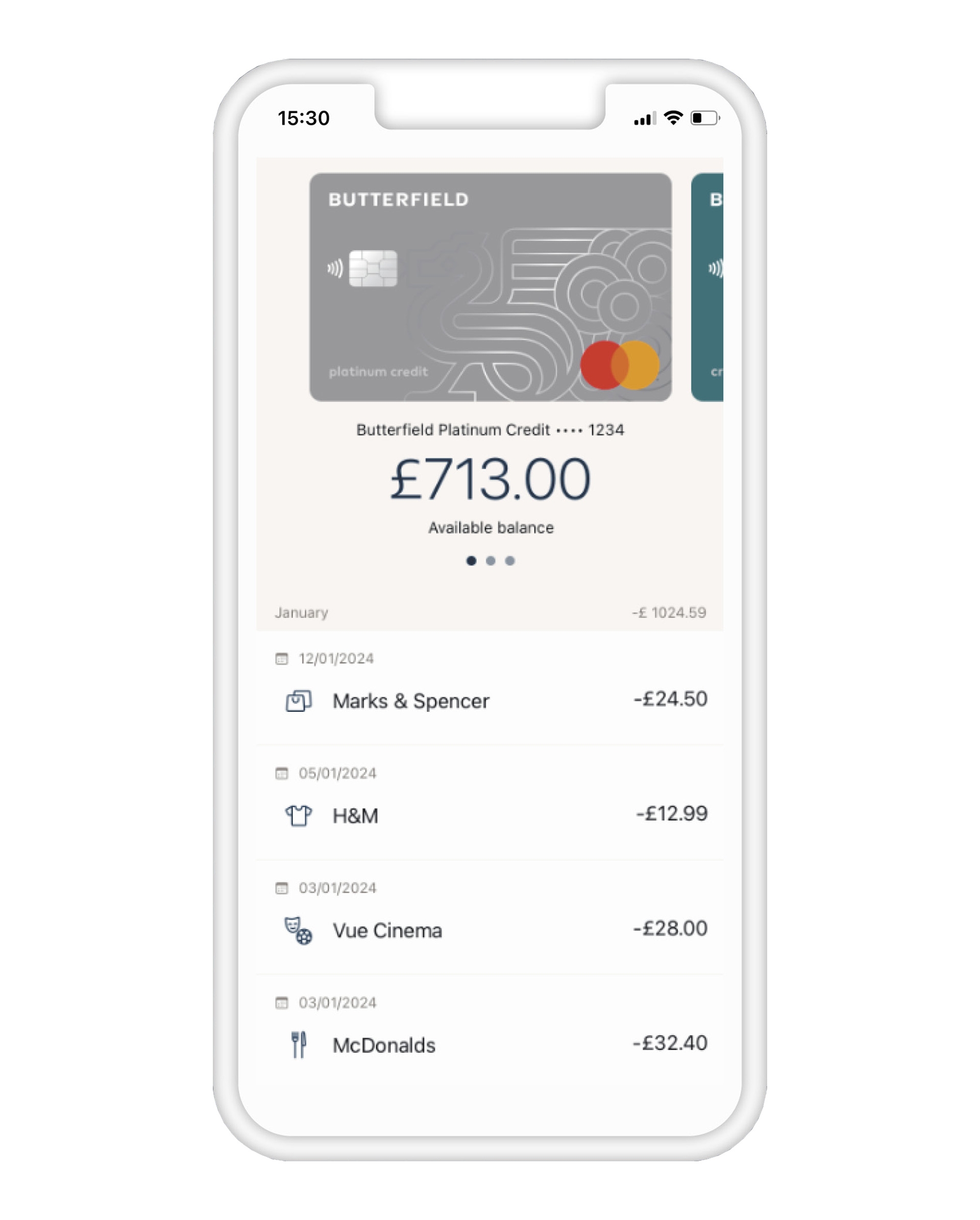

Once you have downloaded and activated your Butterfield Cards CI app, you can view your card details and add your card to your wallet to start using immediately.

Your physical card will take approximately 2-3 weeks to arrive.

Your PIN can be viewed in your Butterfield Cards CI app by clicking on the card image and selecting ‘ See Your PIN’.

Your new card can be activated within your Butterfield Cards CI app. You can also activate by using Chip and PIN for your first purchase or by using it at an ATM. Contactless transactions can be enabled by making a Chip and PIN payment.

If your card is lost, it can be blocked within your Butterfield Cards CI app. Blocking your card will not stop any recurring transactions.

If you find your card, you can instantly unblock it through the app.

You can report your card lost, stolen or damaged and request a replacement by calling 24/7 Butterfield Card Services at +44 (0) 808 175 6552

Your card can be cancelled by calling 24/7 Butterfield Card Services at +44 (0) 808 175 6552

You can add up to 5 additional cardholders on each credit card once your application has been approved. To invite an additional card holder, please visit your Butterfield Cards CI app and follow the instructions to complete the process.

The app can be downloaded for free from the App Store or Google Play.

Yes, all of our packaging is fully recyclable and can be disposed of with your usual cardboard recycling.

Once your card has expired or cancelled it will be blocked and therefore unusable. Our standard and platinum credit cards can be cut with scissors or disposed of in a suitable shredder. To dispose of your World Elite card, please cut with metal scissors.

Alternatively all of our cards can be dropped to our office in either Jersey or Guernsey for disposal.

Guernsey: Martello Court, Admiral Park, St. Peter Port, Guernsey GY1 3AP, Channel Islands

Jersey: IFC6, IFC Jersey, St. Helier, Jersey JE4 5PU, Channel Islands

You are eligible to apply for a Butterfield credit card if you are over 18 and a resident in the Channel Islands. You do not have to be an existing client of Butterfield to apply. You will need a smartphone or tablet in order to download the Butterfield Cards CI app.

When uploading your bank statement, proof of address or proof of income, please ensure that there are no spaces or special characters in the name and the file size is under 5MB.

You can save and leave your application and return at a later date to complete it. Upon selecting the save and leave button you will receive instructions via email of how to recommence your application. Before selecting save and leave please ensure you have completed the page of the application process that you are on.

If you are an existing client of Butterfield, please have available your mobile device and your Butterfield Online login details.

If you are new to Butterfield, please have to hand your passport, mobile device and have access to your most recent bank statement and proof of income. If you are applying in Jersey you will also require a proof of address.

When choosing your memorable word during your application please ensure you have entered it into both boxes before proceeding. It needs to be 8 characters with one uppercase letter.

To complete the address section of the application please re-enter your island of residence in the parish field.

If you are having issues completing your application please contact us on +44 (0) 808 175 6552 and select option 3.

We offer in-person appointments if you don’t feel comfortable applying online. Please contact us on +44 (0) 808 175 6552 and select option 3.

Apple, the Apple logo, iPad, iPhone, and iPod touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android is a trademark of Google Inc. Google PlayTM is a trademark of Google Inc.

Butterfield does not charge a fee for Mobile Banking. However, third party message and data rates may apply from your wireless carrier. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. To be able to use this app, a supported mobile device is needed.

Butterfield is regulated in a number of jurisdictions - please click here for Legal & Regulatory information pertaining to Butterfield.

Credit cards are only available to over 18s and residents of the Channel Islands. Credit cards will be issued from Butterfield Bank (Channel Islands) Limited. Butterfield Bank (Channel Islands) Limited (“BBCIL”) is licensed and regulated by the Guernsey Financial Services Commission under The Banking Supervision (Bailiwick of Guernsey) Law, 2020 and The Protection of Investors (Bailiwick of Guernsey) Law, 2020, and The Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022, each as amended from time to time, under registration number 85. BBCIL is a participant in the Guernsey Banking Deposit Compensation Scheme (the “Scheme”) established by The Banking Deposit Compensation Scheme (Bailiwick of Guernsey) Ordinance, 2008 (the “Ordinance”). The Scheme offers protection only in respect of ‘qualifying deposits’ (as that term is used in the Ordinance) of up to £50,000, subject to certain limitations as set out in the Ordinance. The maximum total amount of compensation is capped at £100,000,000 in any 5 year period. Full details are available on the Scheme’s website www.dcs.gg or upon request. Deposits are not covered by the UK Financial Services Compensation Scheme under the Financial Services and Markets Act 2000, nor are deposits covered by any equivalent scheme outside of the Bailiwick of Guernsey. BBCIL is registered under the Data Protection (Bailiwick of Guernsey) Law 2017, under registration number 11160 and with the Guernsey Registry under registration number 21061. BBCIL’s registered office address is P.O. Box 25, Martello Court, Admiral Park, St Peter Port, Guernsey, GY1 3AP. BBCIL’s products and services are available in Guernsey and only in those other jurisdictions where they may be legally offered or obtained. BBCIL is a wholly‐owned subsidiary of The Bank of N.T. Butterfield & Son Limited. Our Privacy policy can be viewed at butterfieldgroup.com/privacy-policy.